Loading

Get Form Schedule M Fillable Modifications To Adjusted Gross Income:

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

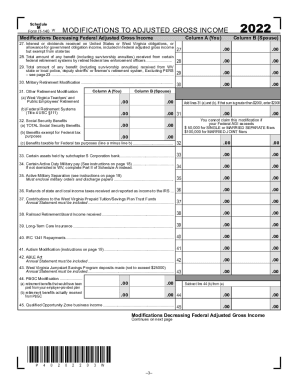

How to fill out the Form Schedule M Fillable Modifications To Adjusted Gross Income online

Filling out the Form Schedule M is an integral part of the tax filing process for individuals seeking to modify their adjusted gross income. This guide provides a comprehensive walkthrough to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editing tool.

- Begin by entering your personal information in the designated sections at the top of the form, including your name, address, and Social Security number.

- In Column A, complete rows 27 through 44 for modifications decreasing your federal adjusted gross income. Provide the amounts as applicable for each category, such as interest received on obligations, retirement modifications, and specific benefits.

- If applicable, complete Column B for your spouse, mirroring the entries made in Column A for the corresponding categories to ensure all modifications are accounted for.

- Proceed to rows 46 through 48 to detail any additional deductions or modifications. Specify any income not included in previous lines and enter your respective totals.

- Move to the section labeled 'Modifications Increasing Federal Adjusted Gross Income' and fill out rows 50 through 58, recording any required additions to your income.

- After filling all required fields and checking for accuracy, use the options provided to save your changes, download the completed form, print it for your records, or share it as necessary.

Complete your tax documents online today to ensure a smooth filing experience.

Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items — like exempt or excluded income and certain deductions. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans. MAGI can vary depending on the tax benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.