Loading

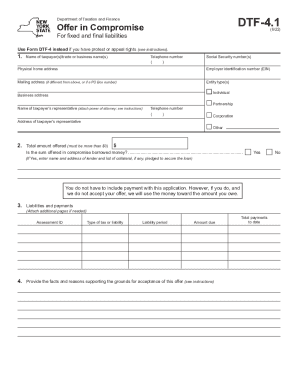

Get Form Dtf-4.1 Offer In Compromise For Fixed And ... - Tax.ny.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DTF-4.1 Offer In Compromise online

Filling out Form DTF-4.1 is a crucial step for users seeking to compromise their tax liabilities. This guide provides clear and concise instructions to assist individuals and businesses in completing the form accurately and effectively.

Follow the steps to fill out the Form DTF-4.1 Offer In Compromise.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the full name and contact information of the taxpayer or business. If it is a joint liability, include both names.

- Indicate the entity type by marking an X in the appropriate box (individual, partnership, corporation, or other).

- Enter the total amount you are offering for the compromise. This amount must be greater than $0.

- List all liabilities you wish to compromise, including Assessment IDs, types of tax, liability periods, and amounts due.

- Provide the facts and reasons supporting your offer. Attach additional documents if necessary.

- Review the conditions outlined in Section 5 to ensure you understand and agree with them before signing.

- After completing the form, save your changes, and prepare to download, print, or share it as needed.

Start filling out your Form DTF-4.1 online today to take the first step toward resolving your tax liabilities.

If you agree you owe the tax and you decide to submit an offer, you'll need to give the IRS complete financial information. Make a list of your income, expenses, assets and any debts owed against those assets. Follow the instructions in Form 656B Booklet, Offer in Compromise Booklet, to prepare and file your offer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.