Get How To Fill Out Nc Form 1276

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out Nc Form 1276 online

Filling out the How To Fill Out Nc Form 1276 online can streamline the process of submitting your International Fuel Tax Agreement return. This guide offers clear, step-by-step instructions to help you navigate each section of the form, ensuring accuracy and compliance with North Carolina regulations.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the document and open it in your browser.

- Input your company's name, street address, city, state, and zip code, as well as the period covered by the return.

- Locate your North Carolina Department of Revenue Identification Number (NCDOR ID) and input it; this ID is crucial for your account identification.

- Indicate the type of return you are filing by selecting one of the options: "No activity," "amended return," or "address change" by filling in the appropriate circle.

- If you need to close an account, prepare to complete and submit Form NC-BN along with your Gas-1276 for processing.

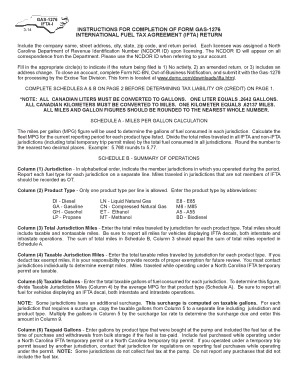

- Proceed to fill out Schedules A and B found on Page 2 before determining your tax liability on Page 1.

- For Schedule A, calculate the miles per gallon (MPG) for the current reporting period by dividing total miles traveled by total fuel consumed. Round the result to two decimal places.

- On Schedule B, list each jurisdiction alphabetically, and provide the necessary details regarding miles traveled and fuel consumed as outlined.

- For Columns 3 to 10 on Schedule B, enter total jurisdiction miles, taxable jurisdiction miles, taxable gallons, tax-paid gallons, and additional calculations as required.

- Sum up your findings; for Line 1, report total tax or credit due from Schedule B.

- If applicable, add penalties and interest to determine your total balance due.

- Complete necessary signatures and contact information before submitting the form.

- Once all information is accurately entered, save any changes made, and you may choose to download, print, or share the completed form.

Start completing your documents online for a smoother experience.

Claiming an exemption from withholding involves filling out the appropriate form and indicating your eligibility clearly. Review the requirements for claiming the exemption and provide accurate supporting information. This helps avoid unnecessary tax withholdings from your paycheck. For specific insights on how to fill out NC Form 1276, uslegalforms offers guidance tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.