Loading

Get Sc Dor I-295 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR I-295 online

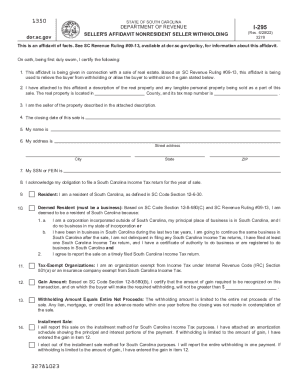

The SC DoR I-295 is an important seller's affidavit related to nonresident seller withholding in South Carolina. This guide will provide clear, step-by-step instructions for filling out the form online, ensuring that users can complete the process with confidence.

Follow the steps to successfully complete the SC DoR I-295 online.

- Click ‘Get Form’ button to access the SC DoR I-295 form and open it in the editor.

- Begin by completing the first section, which confirms that this affidavit is related to a sale of real estate and certifies that it is being used to relieve the buyer from withholding or allows the buyer to withhold based on the stated gain.

- In the next section, provide a description of the real property, including the county where it is located and its tax map number.

- Next, input your information in the seller section, including your name, address (street address, city, state, ZIP), and either your Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Indicate the closing date of the sale accurately.

- Acknowledge your obligation to file a South Carolina Income Tax return for the year of sale.

- Specify whether you are a resident of South Carolina or deemed a resident by checking the appropriate boxes and providing additional required information.

- Certify the amount of gain associated with the transaction that the buyer will use for withholding.

- If applicable, indicate if you are electing the installment sale method or if you are exempt from taxes due to status as a principal residence or other categories provided in the form.

- Complete the remaining sections as necessary, then print the form for signature.

- Finally, ensure that you save your changes, download the completed form, and keep it for your tax records. Do not send it to the South Carolina Department of Revenue unless requested.

Complete your SC DoR I-295 form online today to ensure a smooth and compliant transaction.

Under the State Income Tax Levy Program, the IRS can levy (take) your state tax refund to offset back taxes, addressing any tax debt you might owe. If this happens, the state will give you notice of the levy. The IRS will also give a notice, after the levy, offering you the opportunity to appeal the debt offset.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.