Loading

Get Mo Rd-113 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO RD-113 online

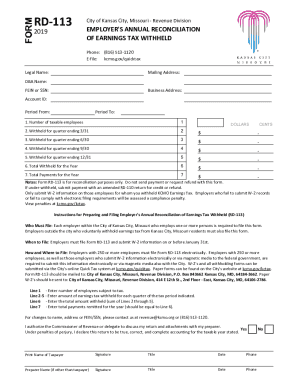

Filling out the MO RD-113 form is an essential process for employers in Kansas City, Missouri, to reconcile earnings tax withheld from employees. This guide provides clear instructions to help users accurately complete the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the legal name of your business in the designated field. If applicable, also include your Doing Business As (DBA) name.

- Input your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) in the appropriate section.

- Fill in your business address, ensuring all details are accurate and up-to-date.

- Record your Account ID in the specified field. This may be obtained from prior filings or communications.

- Indicate the tax period by entering the start date in the section labeled 'Period From.'

- Input the end date of the tax period in the 'Period To' field.

- For 'Number of taxable employees', enter the total number of employees who were subject to withholding during the tax year.

- For lines 2 to 5, provide the amounts of earnings tax withheld for each quarter (ending 3/31, 6/30, 9/30, and 12/31).

- Calculate the 'Total Withheld for the Year' and enter this amount on line 6 (sum of lines 2 through 5).

- On line 7, enter the total payments made for the year. This should match the total withheld amount from line 6.

- Authorize the Commissioner of Revenue to discuss your return by selecting the appropriate option and providing your name, signature, title, and date.

- If someone other than yourself prepared the form, provide the preparer's name, signature, title, and date.

- Review all the information for accuracy. Once verified, follow the instructions to save changes, download a copy, print, or share the completed form.

Complete your documents online now to ensure timely and accurate filing.

What is form Rd 109nr? This form is used in conjunction with the Wage Earner Return - Earnings Tax (Form RD-109) to calculate a refund or an overpayment of taxes for services performed outside of Kansas City, Missouri.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.