Loading

Get Appendix A To Subpart I Of Part 103 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Appendix A to Subpart I of Part 103 form online

This guide provides a clear and supportive approach to filling out the Appendix A to Subpart I of Part 103 form online. By following the steps outlined below, users will be equipped to complete the certification regarding correspondent accounts for foreign banks efficiently.

Follow the steps to complete the form accurately

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

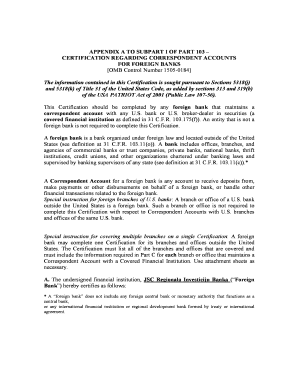

- Begin by filling out Section A, where you will certify the identity of the foreign bank by entering the institution's name. For example, you may write 'JSC Regionala Investiciju Banka'. Make sure this matches exactly with official documents.

- In Section B, specify the correspondent accounts covered by this certification. You can select either to indicate that this certification applies to all accounts established for the foreign bank by covered financial institutions, or specifically name a financial institution, such as 'Deutsche Bank Trust Company Americas, New York, USA'.

- Next, navigate to Section C to confirm physical presence or regulated affiliate status. Check the appropriate box and complete the corresponding fields. If the bank maintains a physical presence, provide the street address, country, and the name of the banking authority that oversees your operations.

- In Section D, certify whether any correspondent accounts are used to indirectly provide banking services. Check the box to confirm that no accounts maintained are indirectly used inappropriately.

- Move on to Section E to provide ownership information. If Form FR Y-7 is on file, check the appropriate box. If the shares are publicly traded, indicate it by selecting the second option. If neither applies, complete the necessary information about the owners.

- In Section F, identify the process agent authorized to accept service of legal process on behalf of the foreign bank. Enter the name and address of this individual or entity, ensuring all details are accurate.

- Finally, complete the signature block at the end of the form. Ensure your name, title, and the date of execution are clearly indicated. Review all sections for completeness and accuracy.

- Once you have filled out all relevant sections, you can save the changes, download a copy for your records, print the form, or share it as necessary.

Complete your forms online today for efficient document management.

US banks are required to recertify each foreign bank every 12 to 18 months, ensuring that the information remains accurate and up to date. This process is crucial for managing risk and maintaining compliance with regulations. By utilizing the guidelines in the Appendix A To Subpart I Of Part 103 Form, banks can efficiently manage the recertification process and uphold their regulatory obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.