Loading

Get Oh It Nrc 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OH IT NRC online

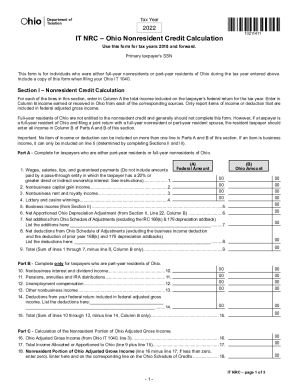

The Ohio Nonresident Credit Calculation (IT NRC) form is essential for individuals who have earned income from Ohio while being nonresidents or part-year residents. This guide provides you with clear, step-by-step instructions on how to complete the form effectively and accurately.

Follow the steps to fill out the OH IT NRC form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the primary taxpayer's Social Security Number (SSN) in the designated field at the top of the form. Ensure that all details are accurate as they are critical for identification.

- Specify the tax year for which you are filing the form. This form is applicable for tax years starting from 2018.

- In Section I, Nonresident Credit Calculation, for each income source listed in Column A, enter the total income as reported on your federal return. This includes wages, nonbusiness capital gains, and others as specified.

- In Column B of Section I, report the income earned or received in Ohio corresponding to each source listed. Make sure not to duplicate any income entries.

- Complete Part A of Section I if you are a part-year resident or full-year nonresident of Ohio by accurately entering your income sources. If applicable, complete Part B only if you are a part-year resident.

- Proceed to calculate your Nonresident Portion of Ohio Adjusted Gross Income in Part C by following the outlined formula, subtracting the total income allocated or apportioned to Ohio.

- For Section II, report each business income or loss received during the tax year, and ensure clarity in reporting the figures in their respective columns.

- If you have business patterns, proceed to fill out Section III for each business with Ohio apportionment, calculating the corresponding Ohio apportionment ratio and income.

- Once you have completed all sections, review your entries for accuracy, then save your changes, download, print, or share the form as needed.

Complete your OH IT NRC form online today to ensure a smooth filing process.

Nonresident – A nonresident with income earned in Ohio will be subject to Ohio tax. A nonresident taxpayer is allowed a “nonresident” credit for all income not earned or received in Ohio.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.