Loading

Get Ma Form 1 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form 1 online

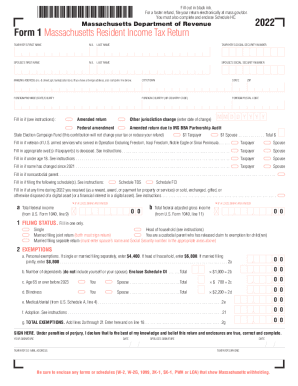

Filling out the MA Form 1 online can streamline your Massachusetts resident income tax return process. This guide provides user-friendly, step-by-step instructions for completing the form, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete the MA Form 1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal details in the taxpayer sections. Fill in your first name, middle initial, last name, and social security number. Then, complete the same fields for your spouse if applicable.

- Input your mailing address in the specified fields, ensuring to include details such as street number and name, city or town, state, and ZIP code. If you have a foreign address, fill in the required additional fields for the foreign province, country, and postal code.

- Indicate if you are filing an amended return or if there are changes due to other jurisdictions by checking the appropriate boxes and entering the required dates.

- Select your filing status by checking one box that reflects your situation: single, head of household, married filing jointly, or married filing separately. Ensure to provide your spouse’s name and social security number if filing jointly.

- Fill out the exemptions section, including personal exemptions and the number of dependents. Calculate the amounts based on the instructions provided for each category.

- Report your income in the income section. Enter details from your W-2 forms and any relevant reports. Ensure you provide totals accurately.

- Complete the deductions section, entering amounts paid for Social Security, Medicare, and any rental deductions. Add your total deductions together.

- Calculate your 5.0% income after deductions and enter this value in the appropriate field. Also calculate your taxable income and tax owed using the provided tables.

- Complete the credits section by entering any applicable credits and subtracting these from your total tax calculated earlier. Ensure accuracy in any refund or payment amounts.

- Sign the form where indicated, providing your email address and phone number for any follow-ups. Don’t forget to include required schedules or forms.

- Once completed, save your changes and utilize options to download, print, or share the form as necessary.

Start filling out your MA Form 1 online today to ensure a smooth tax filing experience.

Form 1: Massachusetts Resident Income Tax Return. Form 1-NR/PY: Massachusetts Nonresident or Part-Year Resident Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.