Loading

Get Pdf Caution: This Tax Return Must Be Filed Electronically. - Mass.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF CAUTION: This Tax Return Must Be Filed Electronically. - Mass.gov online

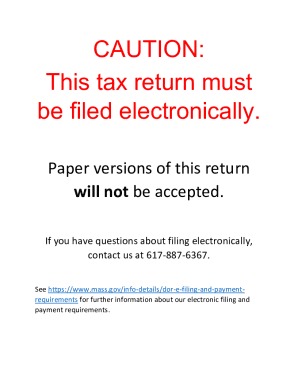

In this guide, we will walk you through the process of properly filling out the PDF titled 'CAUTION: This Tax Return Must Be Filed Electronically' from Mass.gov. This document is crucial for ensuring that your tax return is submitted correctly and accepted electronically.

Follow the steps to fill out your tax return accurately.

- Press the ‘Get Form’ button to download the form and open it in your preferred PDF reader for editing.

- Enter the tax year by filling in the tax year beginning and tax year ending dates. Calendar year filers should include '01-01-2021' and '12-31-2021'. Ensure that the dates correspond correctly based on your filing preferences.

- Fill in the 'Name of Partner' field with the full legal name of the individual or entity. Then, input the 'Taxpayer Identification Number' to uniquely identify the partner.

- Complete the address section by providing the 'Address,' 'City/Town/Post Office,' 'State,' and 'ZIP + 4' codes. This information helps in verifying your identity and residence.

- For the 'Name of Partnership,' input the complete name of the partnership as registered with the IRS. Additionally, provide the 'Federal Identification Number' required for tax identification of the partnership.

- Indicate if any loss is applicable by marking an 'X' in the provided box for the 'If a loss, mark an X in the box.'

- In the section regarding the partner's distributive share, enter the relevant figures for Massachusetts ordinary income or loss, guaranteed payments to partners, and any separately stated deductions as applicable.

- Ensure that you summarize lines 1 through 3 in line 4 by adding those amounts, as this total will be critical for determining the overall income.

- Continue by entering any available credits and other pertinent financial information as indicated in the relevant boxes throughout the form.

- After completing all the required sections, you can save changes, download, print, or share the form as necessary to facilitate your electronic filing.

Make sure to complete your documents online and file your tax return electronically for a streamlined process.

Related links form

For tax years beginning on or after January 1, 2021, the new law allows eligible PTEs to pay an elective excise tax on qualified income taxable in Massachusetts. Eligible PTEs are S corporations, partnerships and LLCs treated as S corporations or partnerships. The tax rate for all electing PTEs is 5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.