Loading

Get 82 052a Ia Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 82 052a Ia Form online

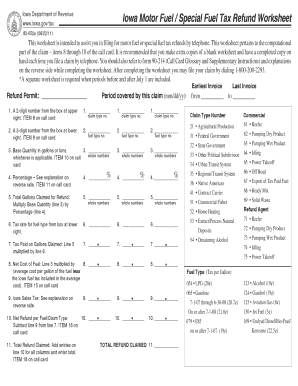

This guide provides a clear and comprehensive overview of how to fill out the 82 052a Ia Form online, designed for users of all experience levels. Following the steps outlined here will facilitate the process of filing for motor fuel or special fuel tax refunds.

Follow the steps to complete the 82 052a Ia Form online

- Click ‘Get Form’ button to obtain the 82 052a Ia Form and open it in your preferred document editor.

- Enter the refund permit number associated with the claim type at the start of the form. This number is essential for identifying your claim.

- Specify the period covered by your claim by entering the earliest invoice date and last invoice date in the required format (MM/DD/YY).

- Locate and enter the Claim Type number using the two-digit code corresponding to the type of claim you are filing. Ensure to reference the related section for accuracy.

- Find the Fuel Type number using the respective three-digit code for the fuel represented in your claim. This information is critical for processing your refund.

- Input the Base Quantity in gallons or tons as applicable. Ensure to report as whole numbers for accurate refund calculations.

- Enter the percentage relevant to your claim type, ensuring it is noted in decimal form (e.g., 30% as 30.00) as per the instructions.

- Calculate the Total Gallons Claimed for Refund by multiplying the Base Quantity from step 6 by the percentage from step 7. Record this number in the specified field.

- Specify the Tax rate for the fuel type selected based on current rates provided in the form.

- Compute Tax Paid on Gallons Claimed by multiplying the Total Gallons Claimed for Refund by the Tax rate entered in step 9.

- Determine the Net Cost of Fuel by taking the average cost per gallon of fuel, subtracting the applicable Iowa fuel tax, and performing the multiplication based on the Total Gallons.

- Calculate the Net Refund per Fuel/Claim Type by subtracting any applicable Iowa sales tax from the Tax Paid from step 10.

- Sum the Net Refunds to find the Total Refund Claimed, ensuring all entries are included. Double-check calculations for accuracy.

- Once all fields are filled out and verified, save changes to the form, and proceed to download, print, or share the completed document as needed.

Ready to file? Complete your documents online now!

Filling out an Illinois withholding form involves inputting your personal information accurately and selecting the appropriate filing status. Use the 82 052a Ia Form to determine the correct number of allowances you should claim. Double-check your entries to ensure they are correct as these can affect your taxes owed. Uslegalforms provides templates and instructions that can make this task easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.