Loading

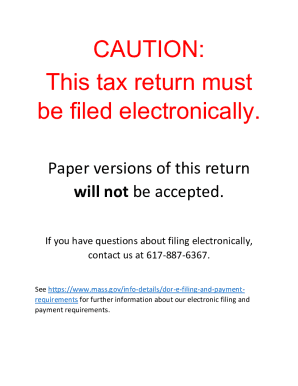

Get Caution: This Tax Return Must Be Filed Electronically. - Mass.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CAUTION: This tax return must be filed electronically - Mass.gov online

Filing your tax return electronically is a crucial requirement outlined by the Massachusetts Department of Revenue. This guide provides a clear and user-friendly approach to help you navigate the process of completing the CAUTION tax return form online, ensuring that you meet all the necessary requirements.

Follow the steps to complete your tax return electronically

- Press the ‘Get Form’ button to access the electronic version of the CAUTION tax return form.

- Identify whether you are a calendar year or fiscal year filer. Enter the corresponding tax year starting and ending dates in the specified fields.

- Fill in the corporate name and federal identification number (FID) accurately. These fields are essential for identifying your entity.

- Insert the principal business address, including city, state, and ZIP code. If your business address in Massachusetts differs, fill in that information in the next section.

- If you are submitting an amended return or any other special situation (federal amendment, final Massachusetts return, etc.), be sure to check the appropriate boxes to indicate this.

- Complete each section regarding the type of corporation, date of incorporation, average number of employees, and other details as required by the form.

- Proceed to the excise calculation section. Follow the instructions to calculate taxable property, income, and applicable tax liabilities.

- After entering all data, review the form to ensure accuracy. Once confirmed, you can finalize the submission process as required.

- To complete the process, save changes, download a copy for your records, or print the completed form for your reference.

File your documents online today to ensure compliance and a smooth filing experience.

If you're a full-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return. If you're a part-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.