Loading

Get Nj Nj-2450 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-2450 online

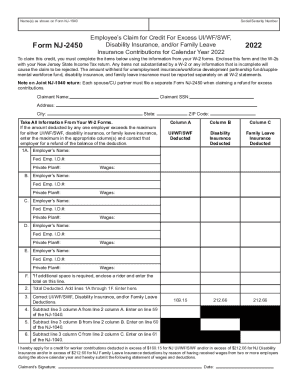

Filling out the NJ NJ-2450 form correctly is essential to claim your credit for excess contributions for unemployment insurance, disability insurance, and family leave insurance. This guide will provide step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to effectively complete the NJ NJ-2450 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your name as shown on your Form NJ-1040 in the designated field labeled 'Claimant Name.'

- Input your Social Security number in the 'Claimant SSN' section. Ensure this number matches your official documents.

- Provide your address, including city, state, and ZIP code in the specified format.

- Refer to your W-2 forms to fill out the deductions. Record the amounts deducted for unemployment insurance/workforce fund/supplemental workforce fund in 'Column A', disability insurance in 'Column B', and family leave insurance in 'Column C'.

- For each employer listed (1A to 1F), fill in the employer's name, federal employer identification number, private plan number, and wages in the respective fields.

- If you have more employers than spaces provided, attach an additional sheet with the necessary employer information and enter the total on the line provided.

- Calculate the total deducted by adding the values from lines 1A through 1F and enter this total in the 'Total Deducted' field.

- Complete the calculations based on the deductions to determine the correct contributions owed. Enter these amounts into the fields as instructed.

- Finalize the form by signing and dating where indicated. Ensure all information is accurate before submission.

- Once completed, save your changes, and consider downloading or printing a copy for your records. Also, be sure to include this form with your New Jersey State Income Tax return.

Take action now and complete your NJ NJ-2450 form online to ensure you receive your entitled credits!

Related links form

New Jersey does not allow you to exclude from wages amounts you contribute to deferred compensation and retirement plans, other than 401(k) Plans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.