Loading

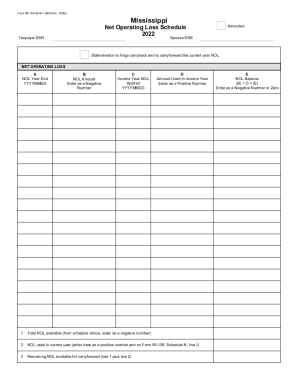

Get Ms Dor Form 80-155 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-155 online

Filling out the MS DoR Form 80-155 online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide provides detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the MS DoR Form 80-155 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your taxpayer Social Security Number (SSN) in the designated field. Make sure to use the correct format and double-check for accuracy.

- If applicable, enter your spouse's SSN in the appropriate field.

- Indicate your state election to forgo the carryback by checking the appropriate box, ensuring that you clearly understand the implications of this choice.

- For the NET OPERATING LOSS (NOL) section, provide the following: A. Enter the NOL year end date in the format YYYYMMDD. B. Input the NOL amount as a negative number. C. Specify the income year the NOL will be applied to in the format YYYYMMDD. D. Note the amount used in the income year as a positive number.

- Calculate the total NOL available by summing the values from the NOL schedule above and input this as a negative number in the specified field.

- Enter the NOL used in the current year as a positive number, and ensure to reference this number on Form 80-108, Schedule N, line 1.

- Calculate the remaining NOL available for carryforward by adding line 1 and line 2 and input this value in the designated field.

- For the NOL balance (E), sum column B and D, and record this as a negative number or zero in the relevant field.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Begin filling out your documents online to ensure accuracy and efficiency.

You must file a Mississippi Non-Resident / Part-Year Return Form 80-205.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.