Get Completion Instructions For Notice Of Reduced Earnings

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Completion Instructions For Notice Of Reduced Earnings online

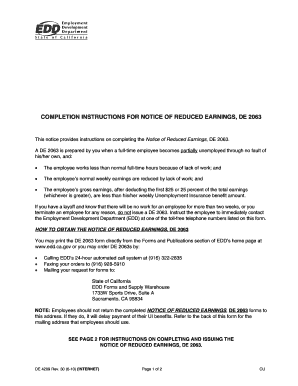

Completing the Notice Of Reduced Earnings, DE 2063, is essential for addressing situations when a full-time employee experiences reduced hours due to no fault of their own. This guide provides clear, step-by-step instructions to help you navigate the form effectively and accurately.

Follow the steps to complete the Notice Of Reduced Earnings form.

- Click the ‘Get Form’ button to access the Notice Of Reduced Earnings, DE 2063 form. This action enables you to open the form in your online editor for completion.

- Enter the employee’s full name and Social Security Number in the designated fields. Ensure spelling and numbers are accurate for proper identification.

- Complete the ‘Employer’s Statement for the Payroll Week Ending’ by entering the date that marks the end of your payroll week.

- Fill in items 1 through 4 under the ‘Employer’s Statement.’ Include all reportable earnings, such as commissions, bonuses, and any non-cash payments like lodging or meals.

- Proceed to complete the ‘Employer’s Certification.’ Provide your company name, telephone number, address, the signature of the employer or authorized representative, employer account number, and the date you are issuing the form to the employee.

- Hand the completed DE 2063 to the employee and clearly instruct them on the next steps they need to take regarding this form.

- Advise the employee to complete the ‘Claimant’s Statement’ located at the bottom of the form. If needed, they can utilize the Spanish or Chinese translations provided on the reverse side as guidance.

- If the employee has an active claim within the last 12 months, instruct them to mail the completed DE 2063 to the specified Employment Development Department address. If they are unsure or have not established a claim, they should contact EDD before mailing.

- Inform the employee about the importance of submitting the form or contacting EDD within 28 days from the date the DE 2063 was issued to comply with filing deadlines.

- Once all the fields are accurately filled and information confirmed, users can save their changes, download the form, or print it for their records.

Ensure timely processing by filling out the Notice Of Reduced Earnings online today.

In California, misconduct can disqualify you from receiving unemployment benefits, as it implies a failure to meet work responsibilities. Specific actions, such as theft or repeated tardiness may fall under this category. By following the Completion Instructions For Notice Of Reduced Earnings, you ensure that your claim does not inadvertently conflict with any misconduct issues. Being aware of these factors can help you safeguard your eligibility for benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.