Loading

Get La Dor R-8453f 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-8453F online

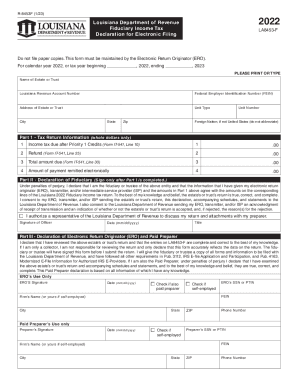

Filling out the LA DoR R-8453F form is a critical step for fiduciaries when submitting Trust or Estate income tax returns electronically. This guide provides comprehensive, step-by-step instructions to help you navigate the online form efficiently.

Follow the steps to complete your LA DoR R-8453F form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by providing the name of the estate or trust at the top of the form.

- Enter the Louisiana revenue account number associated with the estate or trust.

- Input the federal employer identification number (FEIN) for the estate or trust.

- Fill in the address details, including street address, unit type, city, state, and zip code.

- Specify the unit number if applicable, and indicate the foreign nation if the estate or trust is based outside the United States.

- In Part I, report whole dollar amounts related to the estate or trust's income tax return. Complete lines 1 to 4 accurately, reflecting the totals from Form IT-541.

- Proceed to Part II to declare that the information is true and complete. Ensure all fields are filled correctly before signing.

- The fiduciary or trustee must sign and date the form in the appropriate section.

- In Part III, if applicable, the Electronic Return Originator (ERO) will review and sign the declaration after confirming the accuracy of the entries.

- Finalize the form by ensuring all relevant signatures are completed, and then save your changes.

- Download, print, or share the completed form as per your needs.

Complete your documents online to ensure efficient processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.