Loading

Get Ks K-40pt 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-40PT online

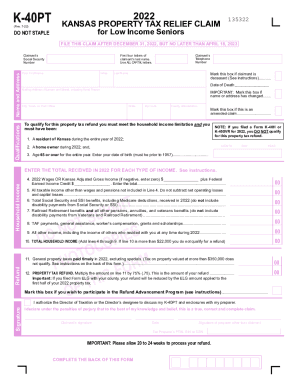

The KS K-40PT form is essential for low-income seniors in Kansas seeking property tax relief. This guide provides clear and straightforward instructions to assist you in completing the form online accurately and efficiently.

Follow the steps to complete the KS K-40PT form online.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin by entering the claimant's personal details in the designated fields. This includes their name, address, Social Security number, and telephone number. Ensure that you use all capital letters for the first four letters of the claimant's last name.

- Indicate whether the claimant is deceased by marking the appropriate box and providing the date of death if applicable.

- Confirm the claimant’s residency and home ownership status for the year 2022 by answering the qualification questions. Enter the claimant’s date of birth, ensuring they are 65 years old or older.

- Proceed to document the household income received during the year. Fill in the total amounts for each type of income as requested on the form, ensuring precision to secure the correct tax refund.

- After gathering that information, sum the total household income. If this amount exceeds $22,000, be aware that the claimant does not qualify for a refund.

- Next, enter the total property taxes paid for the year 2022 on the appropriate line. Remember that only timely paid taxes qualify and follow specific instructions regarding property valued above $350,000.

- Calculate the property tax refund by multiplying the amount from the previous step by 75%. Enter this amount on the designated line.

- If applicable, indicate participation in the Refund Advancement Program by marking the corresponding box.

- Ensure the form is signed by the claimant and, if necessary, by a tax preparer. Include the preparer's PTIN, EIN, or SSN.

- Finally, review the entire form for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out the KS K-40PT online today to secure your property tax relief.

The Senior or Disabled Veteran (SVR) property tax refund claim (K-40SVR) allows a refund of property tax for senior citizens or disabled veterans. The refund amount is the difference between the current and base year property tax amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.