Get Childs Interest And Dividends Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Child's Interest And Dividends Form online

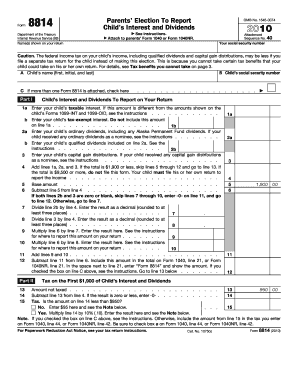

Filing the Child's Interest And Dividends Form, known as Form 8814, allows parents to report their child's income without the need for a separate return. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the Child's Interest And Dividends Form online

- Click 'Get Form' button to obtain the form and open it in your preferred online editor.

- In the first section, enter the names as they appear on your tax return. This will also require providing your child's name and social security number.

- In Part I, report your child's interest and dividends. Start by entering the taxable interest amount from your child's Forms 1099-INT and 1099-OID into line 1a.

- Proceed to line 1b and input any tax-exempt interest your child received. Ensure this amount is separate from line 1a.

- For dividends, enter any ordinary dividends received on line 2a. If any of these dividends are qualified, record that amount on line 2b.

- On line 3, enter the capital gain distributions your child received, ensuring accuracy with the respective documents.

- Add the amounts from lines 1a, 2a, and line 3 on line 4. If the total is below $1,900, you can skip the next lines and proceed to line 13.

- If necessary, complete lines 5 through 12 if your total is more than $1,900, following the instructions provided for each line.

- Finally, review all entries for accuracy. Once complete, you can save the changes, download a copy, print, or share the form as needed.

Start filing your Child's Interest And Dividends Form online today for a seamless tax experience.

Related links form

A parent's election to report a child's interest and dividends on Form 8814 allows parents to include their child's unearned income on their own tax return. This form simplifies the tax process for families, as it combines the child's income with the parent's. To take advantage of this option, the child's investment income must meet specific thresholds. Understanding how to utilize the Childs Interest And Dividends Form effectively can lead to accurate submissions and potential tax savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.