Loading

Get Ks Dor K-41 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR K-41 online

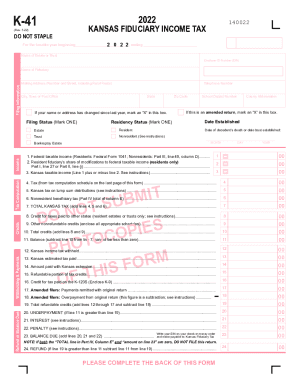

The KS DoR K-41 form is essential for reporting fiduciary income tax in Kansas. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the KS DoR K-41 form online effectively.

- Click the ‘Get Form’ button to obtain the KS DoR K-41 form and open it in your preferred online editor.

- Complete the section for the taxable year, entering the beginning and ending dates for 2022.

- Fill in the name of the estate or trust and the employer identification number (EIN) as required.

- In the 'Filing Information' section, provide the name and contact information for the fiduciary, including telephone number and mailing address.

- Indicate if there has been a change in name or address since the previous year by marking the corresponding box.

- Select the filing status by marking 'Estate' or 'Trust' and choose your residency status by indicating 'Resident' or 'Nonresident'.

- If applicable, indicate if this is an amended return by marking the appropriate box and providing the date established.

- Calculate and enter the federal taxable income on line 1, using information from Federal Form 1041 for residents or equivalent for nonresidents.

- Complete lines 2 through 11, detailing any modifications to the federal taxable income, applicable Kansas tax, and nonrefundable credits.

- Proceed to the Withholding & Payments section to enter any estimated tax paid and to calculate the total refundable credits.

- Check totals on lines for refund or balance due, and ensure all calculations are precise.

- Once completed, review all sections for accuracy, and save your changes before submitting the form.

Get started on filing your KS DoR K-41 form online today!

Related links form

Out-of-State Sales If the retailers sells merchandise to be shipped or delivered to the purchaser out-of-state, then the sales is considered to occur out-of-state, and no Kansas sales tax is due. The out-of-state purchaser may owe compensating use tax in the state where the purchaser is located.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.