Get Ta 2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ta 2 Form online

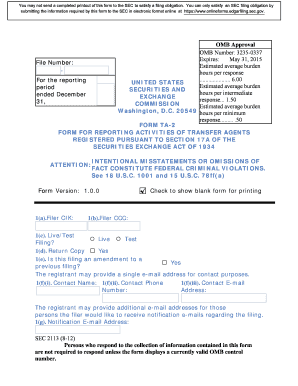

The Ta 2 Form is essential for reporting activities of transfer agents as required by the Securities Exchange Act of 1934. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to effectively complete the Ta 2 Form online.

- Click ‘Get Form’ button to access the form and open it in the designated editor.

- Enter the Filer Central Index Key (CIK) in the appropriate field to identify the reporting transfer agent, ensuring accuracy.

- Provide the Filer Central Control Code (CCC) in the designated section to verify your filing credentials.

- Indicate if this is a live or test filing by selecting the corresponding option from the dropdown menu.

- Specify if you need a return copy of the filing by selecting 'Yes' or 'No' in the appropriate field.

- If this filing is an amendment, indicate so by selecting 'Yes' and provide details of the previous filing.

- Fill in the contact details, including the contact name, phone number, and email address, ensuring all information is correct.

- Complete the necessary sections regarding transfer agent activities, such as whether any service companies were engaged during the reporting period.

- Input the number of items received for transfer and accounts maintained, ensuring the accuracy of all quantitative data provided.

- Review all sections for completeness and accuracy before final submission.

- Once reviewed, save the changes to your form, and then proceed to submit it electronically to satisfy SEC filing requirements.

Complete your Ta 2 Form online now to ensure compliance with SEC regulations.

Filing form stk 2 involves a few essential steps that you should follow to ensure accuracy. Begin by collecting your financial information and understanding the specifics related to your business type. Once you are ready, complete the form and double-check that all figures align with your supporting documents. If you want to make this process even easier, consider using uslegalforms, which offers templates and guidance tailored for filing the stk 2 and similar forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.