Loading

Get Mo Mo-1040a 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1040A online

Filling out the MO MO-1040A online is an essential task for individuals seeking to report their income and taxes accurately in Missouri. This guide provides step-by-step instructions to help users complete the form with ease and confidence.

Follow the steps to complete the MO MO-1040A form online.

- Press the ‘Get Form’ button to access the MO MO-1040A and open it in your preferred editor.

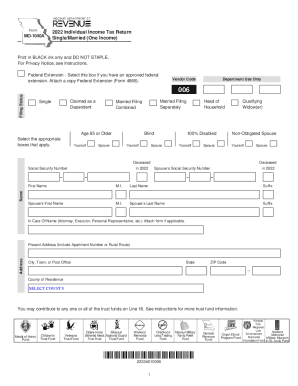

- Begin by selecting your filing status. Indicate if you are single, married filing separately, married filing combined, head of household, or qualifying widow(er) by marking the appropriate box.

- Provide your Social Security number and the Social Security number of your spouse, if applicable, in the designated fields.

- Fill in your name, in care of name if applicable, and your present address, including any apartment number or rural route.

- Specify your county of residence by selecting from the provided options.

- Enter your federal adjusted gross income from your federal tax return on Line 1 and deduct any state income tax refund included in the federal income on Line 2.

- Calculate your total Missouri adjusted gross income by subtracting any state income tax refund from the federal adjusted gross income and enter the total on Line 3.

- Proceed to Lines 4a to 4c. Line 4a requires the tax from your federal return. Line 4b asks for the applicable percentage based on your Missouri adjusted gross income, and Line 4c asks for the federal income tax deduction based on your tax amount on Line 4a.

- Fill out your Missouri standard deduction or itemized deductions on Line 5 according to your filing status.

- Complete the remaining lines by entering any additional exemptions, long-term care insurance deductions, and calculating your total deductions.

- Subtract the total deductions from your Missouri adjusted gross income to determine your Missouri taxable income on Line 9.

- Use the provided tax chart to calculate your Missouri tax and enter this amount on Line 10.

- Input any Missouri tax withheld from Form W-2s and 1099s on Line 11, along with any estimated tax payments made during the year on Line 12.

- Calculate your total payments on Line 13 by adding Lines 11 and 12.

- Determine if you have an overpayment or amount due by comparing Lines 10 and 13, and fill out the respective lines accordingly.

- Complete your refund or amount due to be paid information accordingly.

- Finally, affix your signature and provide the required date, along with your spouse's signature if you're filing jointly.

- After completing all sections, save your changes, download or print the form, or share it as necessary.

Ensure your tax obligations are met by filing your MO MO-1040A online today.

If you have other types of income, such as from a business you operate as a sole proprietorship, you still must report the income since it is taxable, but you must file Form 1040. After reporting your income, the 1040A form allows you to claim certain adjustments to arrive at your adjusted gross income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.