Loading

Get Mo Mo-1040 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1040 online

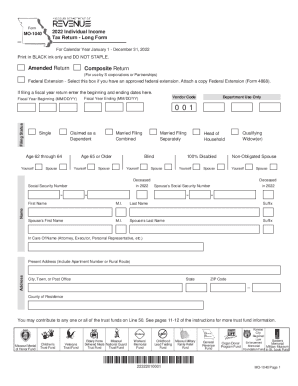

The MO MO-1040 is an important tax form for individuals filing their income tax returns in Missouri. This guide will provide you with a clear and supportive step-by-step process to fill out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to complete your MO MO-1040 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your filing status by selecting the appropriate option from the list provided. This includes options such as Single, Married Filing Combined, or Head of Household.

- Fill in your personal information, including your name, Social Security number, and present address. Ensure that your information is accurate and complete.

- Provide information about your spouse, if applicable. This includes their name and Social Security number.

- Report your income by entering the Federal adjusted gross income from your federal return. If applicable, include your spouse's income as well.

- Add any income adjustments as necessary. These adjustments will include additions and subtractions to your total income.

- Calculate your Missouri adjusted gross income by subtracting any total subtractions from your total income.

- Proceed to list and calculate exemptions and deductions you qualify for, citing relevant lines for long-term care, health care sharing ministry, or any applicable military income deductions.

- Compute your taxable income and the tax based on the provided tax rates. Ensure you are utilizing the correct charts and calculations.

- Continue filing any necessary state credits or payments, including how much Missouri tax was withheld, and any estimated tax payments you made.

- Conclude the form by entering your refund or amount due, and by detailing any donations to trust funds as indicated.

- Once all sections are completed, review your entered information for accuracy. You can then save your changes, download, print, or share the form as needed.

Complete your MO MO-1040 online today to ensure a smooth filing process.

Paying Online The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.