Loading

Get Ny It-112-r 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-112-R online

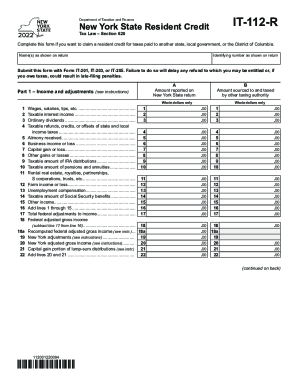

Filling out the NY IT-112-R form is an essential step for individuals seeking to claim a resident credit for taxes paid to another state, local government, or the District of Columbia. This guide will walk you through the process, ensuring you accurately complete each section of the form.

Follow the steps to successfully complete the NY IT-112-R form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name as it appears on your tax return in the appropriate field for names. Ensure your identifying number matches what is shown on your return.

- In Part 1, complete the income and adjustments section by entering whole dollar amounts for various forms of income, including wages, interest, dividends, and unemployment compensation.

- Add up line amounts from 1 through 15 and enter the total on line 16. Then, subtract any federal adjustments from this total, entering the result as your federal adjusted gross income on line 18.

- Follow with adding New York adjustments as specified in the instructions to arrive at your New York adjusted gross income, reflected on line 20.

- Proceed to Part 2, where you will enter the tax imposed by the other state or locality. You will need to provide the two-letter abbreviation of that state on line 23.

- Include the actual amounts paid in taxes on lines 24a and 24b, then calculate the total on line 24.

- After determining the New York State tax payable for this period, proceed to line 26, where you calculate the ratio of amounts sourced to and taxed by the other jurisdiction to those reported on your New York State return.

- Multiply the New York State tax by the ratio calculated in the previous step and enter the result on line 27. Choose the lesser value between line 24 and line 27 for line 28.

- In Part 3, apply the credit by entering tax due before credits and any credits you applied prior to this to find the final amount after credit application.

- In Part 4, if applicable, provide information about tax withheld and overpayments made to the other jurisdiction, completing the related fields as necessary.

- Once all sections are completed accurately, save any changes made to the form. You can choose to download, print, or share the finalized document as needed.

Begin completing your NY IT-112-R form online today to ensure your resident credit is filed correctly.

New York State resident credit (This income generally includes wages and business income. It typically excludes interest, dividends, gambling winnings, and lottery winnings.) you were a shareholder of an S corporation and you pay the tax calculated on the S corporation income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.