Loading

Get Trsl Form 7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trsl Form 7 online

The Trsl Form 7 is crucial for individuals seeking a refund from the Teachers’ Retirement System of Louisiana. This guide provides clear instructions on completing the form online, ensuring a smooth process for all users.

Follow the steps to fill out the Trsl Form 7 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

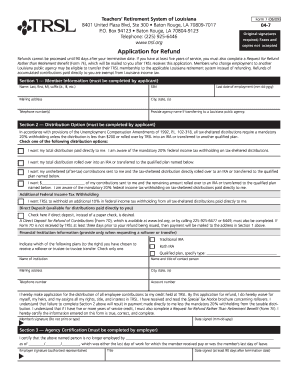

- In Section 1, provide your member information. Here, you will need to input your last name, first name, middle initial, and any suffix. Additionally, enter your Social Security number, last date of employment, mailing address, city, state, zip code, and telephone number. If you are transferring to a Louisiana public agency, include the agency name.

- Proceed to Section 2, where you will select your distribution option. Choose one option for how you would like your total distribution handled—whether paid directly to you, rolled over to an IRA, or partially distributed.

- If you desire additional federal income tax withholding, indicate this in the additional withholding section. You can also choose to have your distribution sent via direct deposit by checking the corresponding box.

- If applicable, complete the financial institution information section by specifying the type of plan you are rolling over to and providing the necessary details of the institution.

- Review the certification statement at the bottom of Section 2. Ensure all information is accurate before signing and dating the form.

- Section 3 requires agency certification. This part must be completed by your employer to verify your employment status and last day of work. Make sure it is signed and dated as required.

- After completing all sections, ensure all signatures are original; faxes and copies are not accepted. Save the changes, download, print, or share the completed form as needed.

Ensure your documents are completed online and submitted accurately to avoid delays in processing.

The time it takes to receive a TRS refund varies depending on several factors, including your situation and the complexity of your application. Typically, you can expect the process to take between 4 to 8 weeks after submitting your TRSL Form 7. To ensure a smoother experience, consider completing the form accurately and providing all necessary documentation. This proactive approach can help expedite the refund process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.