Loading

Get Ca Form 5805 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 5805 online

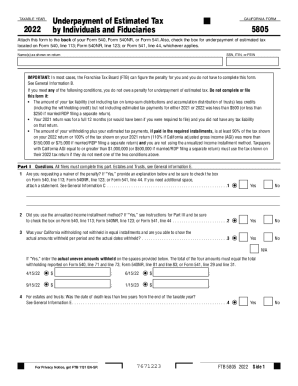

This guide provides a clear and supportive approach to filling out the CA Form 5805 online. This form is utilized by individuals and fiduciaries to calculate any underpayment of estimated tax. By following the steps outlined below, you can ensure accurate completion and submission of this form.

Follow the steps to complete the CA Form 5805 online.

- Click the ‘Get Form’ button to obtain the CA Form 5805 and open it for editing.

- Fill in the first section with your name(s) as shown on your tax return, followed by your Social Security Number, Individual Taxpayer Identification Number, or Federal Employer Identification Number.

- Review the important notes regarding the form. Determine if you meet the criteria that exempt you from the penalty for underpayment. If applicable, proceed to Part I.

- In Part I, answer the questions provided: request a waiver of the penalty and indicate if you used the annualized income installment method. Make sure to check the corresponding box on your main tax form.

- Complete Part II, Required Annual Payment, by entering your 2022 tax after credits, calculating 90% of line 1, and accounting for withholding taxes. Make sure to subtract as necessary and follow the instructions to determine the required annual payment.

- If applicable, proceed to Part III to calculate using the Annualized Income Installment Method Schedule. Only complete this section if you earned income at an uneven rate during the year.

- Finalize your entries by reviewing all fields for accuracy. Save your changes, then download or print the completed form as needed.

Complete your documents online today for efficient management and submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Avoiding underpayment penalties Properly calculating your estimated taxes, making payments early, and paying at least 90% of your last year's tax liability are the best ways to make sure you don't get caught short and charged a penalty.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.