Loading

Get Ny It-203-gr-att-a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-GR-ATT-A online

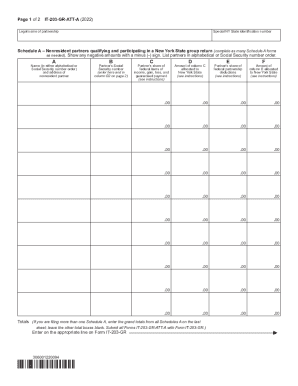

Filling out the NY IT-203-GR-ATT-A form online can simplify the process of reporting nonresident partners’ income and deductions in New York State. This guide will walk you through each section to ensure you complete the form correctly.

Follow the steps to accurately complete your NY IT-203-GR-ATT-A form.

- Click 'Get Form' button to obtain the form and open it in your online editor.

- Fill in the legal name of the partnership at the top of the form. This is required to identify the partnership accurately.

- Enter the special New York State identification number assigned to the partnership. This number is essential for processing your return.

- Complete Schedule A for each nonresident partner qualifying for the New York State group return. Add as many Schedule A forms as needed.

- Calculate the totals across all Schedule A forms. If multiple schedules are filed, enter the grand totals on the last sheet.

- Proceed to page 2 to input the partner's Social Security number again in column B2.

- After filling out all necessary fields, review the entire form for accuracy. Make sure all entries conform to the instructions provided.

Complete your NY IT-203-GR-ATT-A form online to ensure accurate reporting of your partnership income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.