Loading

Get Md Comptroller Mw508 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW508 online

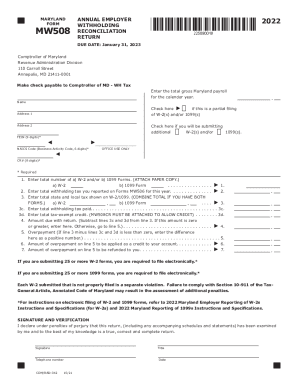

The MD Comptroller MW508 form is an essential document for employers in Maryland to report annual withholding tax reconciliation. This guide will provide clear instructions on how to complete the form online efficiently.

Follow the steps to successfully complete your MW508 form online.

- Click ‘Get Form’ button to obtain the MW508 form and open it in the online editor.

- Enter the total gross Maryland payroll for the calendar year in the designated field.

- Indicate if this filing is partial by checking the appropriate box for W-2(s) and/or 1099(s).

- Provide your name and address in the designated fields.

- Enter your Federal Employer Identification Number (FEIN) in the required field.

- Complete the NAICS code, which identifies your business activity, in the designated space.

- Fill out the total number of W-2 and 1099 forms attached. Make sure to attach the paper copies if necessary.

- Report the total withholding tax you reported on Forms MW506 for the year.

- Input the total state and local tax shown on W-2/1099 forms. If applicable, combine totals for both forms.

- Calculate and enter the total withholding tax paid as well as any tax-exempt credit, if applicable.

- Determine the amount due with the return by subtracting any credits from the total tax.

- Complete the overpayment section if applicable, indicating how much should be applied as a credit or refunded.

- Review all entries for accuracy before saving your changes, downloading, printing, or sharing the MW508 form.

Complete your MW508 form online today for a streamlined filing experience.

Copy this file to a CD or 3 1/2 inch diskette and send it to Comptroller of Maryland, Revenue Administration Division, Attn: Electronic Processing-Room 214, 110 Carroll Street, Annapolis, MD 21411-0001.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.