Get Schedule E Income Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule E Income Calculator online

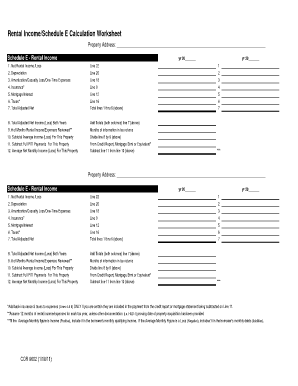

The Schedule E Income Calculator is a vital tool for individuals reporting rental income and expenses. This guide will help you navigate the online form step by step, ensuring that you accurately provide the necessary financial information.

Follow the steps to complete the Schedule E Income Calculator.

- Click ‘Get Form’ button to access the Schedule E Income Calculator and open the form in your browser.

- Begin with Section 1, where you will input your net rental income or loss for each year. This information is typically found on Line 22 of Schedule E.

- Next, move to Section 2 to input depreciation figures, capturing how much value your rental property has lost over time. This corresponds to Line 20.

- For Section 3, enter any amortization, casualty losses, or one-time expenses on Line 18. Make sure to account for any relevant costs associated with your property.

- In Section 4, include the cost of insurance related to the property on Line 9 to ensure comprehensive expense reporting.

- Proceed to Section 5 and input mortgage interest payments made on Line 12. This is essential for understanding your total expenses.

- Section 6 requires you to report taxes associated with the property. Ensure you have this information on hand for accurate reporting.

- Calculate the total adjusted net by summing up all the inputs from Sections 1 through 6 and entering this sum on Line 16.

- Next, proceed to Line 8 to determine the total adjusted net income or loss for both years by adding the totals from both years' columns provided.

- In Section 9, indicate the number of months for which rental income or expenses have been reviewed, typically 12 months unless documented otherwise.

- Line 10 requires you to calculate the subtotal average income or loss for the property by dividing the total adjusted net income from Line 8 by the number of months noted in Line 9.

- Subtract full PITI (principal, interest, taxes, and insurance) payments from the subtotal average income or loss on Line 11 to finalize your property’s average net monthly income or loss, which you will enter in Line 12.

- Review all entries for accuracy and make any necessary adjustments before submitting your form online. After completion, ensure you save your changes, and consider downloading or printing the form for your records.

Start filling out your Schedule E Income Calculator online today to ensure accurate reporting of your rental income and expenses.

You must fill out Schedule E if you earn income from rental properties, partnerships, or S corporations. If you use a Schedule E Income Calculator, it can clarify whether your income sources require you to report on this form. Completing Schedule E ensures compliance and accurate reporting of your income streams. Always review your income situation to determine if filing is necessary.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.