Loading

Get Ny Ct-184 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-184 online

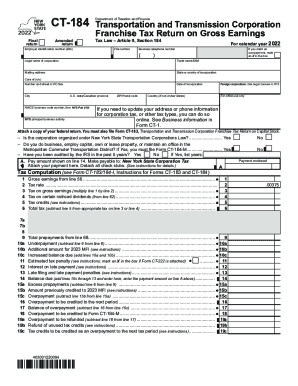

The NY CT-184 is an essential form for transportation and transmission corporations required to report gross earnings for state tax purposes. This guide provides a clear and supportive walkthrough on how to successfully complete this form online.

Follow the steps to efficiently complete the NY CT-184 online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering your employer identification number (EIN) in the designated field. This number is essential for identifying your corporation.

- Provide your legal name, trade name (doing business as), and mailing address. Ensure that all information is accurate and up-to-date.

- Indicate your state or country of incorporation, along with your business telephone number.

- If you claim an overpayment, mark an X in the appropriate box.

- Fill out the date of incorporation and, for foreign corporations, the date you began business in New York State.

- Complete the sections regarding your corporation's business activities, including whether you have been audited by the IRS in the past five years, and the tax rate applicable to your gross earnings.

- Proceed to the tax computation section, carefully entering all relevant figures based on your gross earnings as well as any applicable tax credits.

- If applicable, complete the relevant schedules (A, B, C, D, E, and F) that provide additional details on your operational revenues and allocations.

- Review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as necessary.

Complete your NY CT-184 form online today and ensure your business complies with state tax requirements.

Related links form

Starting in 2022, corporations that derive receipts of $1 million or more are also subject to tax....Tax Bases and Rates. If New York City Receipts are:Fixed Dollar Minimum Tax is:Not more than $100,000$25More than $100,000 but not over $250,000$7510 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.