Loading

Get De Pit-res Instructions 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE PIT-RES Instructions online

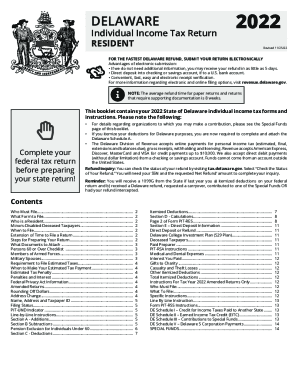

This guide provides comprehensive, step-by-step instructions on how to complete the DE PIT-RES form online, ensuring a smooth and efficient filing process for your Delaware Individual Income Tax Return as a resident.

Follow the steps to successfully complete your DE PIT-RES form.

- Click ‘Get Form’ button to access the DE PIT-RES form and open it in your editor.

- Complete your federal tax return before proceeding with your state return to ensure accuracy.

- Fill in your personal information, including your name, address, and filing status on the relevant sections.

- Follow the line-by-line instructions carefully, completing all applicable lines on the front of the form in the designated order.

- Attach all necessary documents as advised, including W-2 forms and federal tax forms, to ensure a complete submission.

- Sign and date your form, including your contact number to facilitate communication if needed.

- Submit your completed DE PIT-RES form along with any attachments to the appropriate address as indicated in the instructions.

- If applicable, you may also explore options to save changes, download, print, or share your completed form.

Complete your DE PIT-RES document online today for a quicker tax refund!

Delaware does not have a filing threshold for nonresidents. A Delaware personal income tax return must be a nonresident if the taxpayer has gross income attributable to state sources. Part-residents that elect to file Delaware personal incomes as a resident are subject to a filing threshold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.