Loading

Get Ms Form 70-001 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS Form 70-001 online

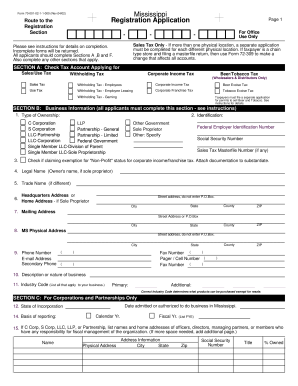

Completing the MS Form 70-001 is essential for individuals and businesses looking to register for various tax accounts in Mississippi. This guide provides a clear, step-by-step approach to ensure that users can efficiently fill out the form online.

Follow the steps to successfully complete the MS Form 70-001.

- Click the 'Get Form' button to access the MS Form 70-001 and open it in your browser.

- In Section A, check the tax account you are applying for, such as Sales/Use Tax or Corporate Income Tax. Make sure to select all applicable options.

- Proceed to Section B to provide business information. Fill in the type of ownership, federal employer identification number, and legal name. Additionally, enter your headquarters address or home address if you are a sole proprietor.

- In Section C, only applicable for corporations and partnerships, provide the date your business was authorized to operate in Mississippi along with the state of incorporation.

- Enter the information required in Section D related to Sales/Use Tax. This includes the previous owner’s name and where records will be maintained. Specify your business's location and whether you have a use tax number.

- Fill out Section E concerning Withholding Tax. Here, you will need to provide estimated monthly liability and the date you first paid Mississippi taxable wages.

- In Section F, sign and date the application. Ensure that the signature is of the authorized owner or officer of the corporation, as indicated in previous sections.

- After completing all sections relevant to your application, review your entries for accuracy before saving your changes. You can download and print the form for your records or submit it electronically.

Begin filling out your MS Form 70-001 online today and ensure your application is completed accurately.

Apply online at the DOR's Taxpayer Access Point portal to receive a Withholding Account Number immediately after completing the registration. Find an existing Withholding Account Number: on Form 89-105, Employer's Withholding Tax Return. by contacting the DOR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.