Loading

Get Il Bca-14.30 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL BCA-14.30 online

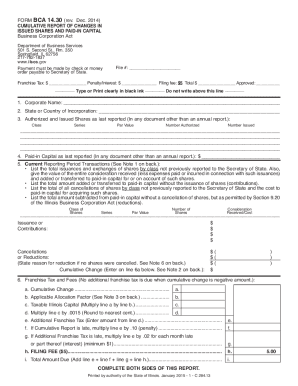

The IL BCA-14.30 form is essential for reporting changes in issued shares and paid-in capital under the Business Corporation Act in Illinois. This guide will provide you with straightforward, step-by-step instructions to successfully complete the form online.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the form and open it in your preferred online platform.

- Enter the corporate name in the designated field, ensuring it is accurate and matches your official documents.

- Provide the state or country of incorporation, filling this out clearly to avoid any potential issues.

- Report the authorized and issued shares as last reported. Fill in the class, series, par value, number authorized, and number issued in the corresponding sections.

- Document the paid-in capital as last reported in the given field.

- Fill out the current reporting period transactions. List all relevant issuances and exchanges, contributions, cancellations, or reductions. Ensure accurate details are provided for each class and series.

- Calculate and enter the cumulative change in the specified field, based on the data you provided previously.

- Complete the franchise tax and fees section by following the guideline calculations provided in the form.

- Fill out transactions from previous reporting periods that have not been reported previously to the Secretary of State.

- Report the authorized and issued shares after changes, and then provide the updated paid-in capital after all adjustments.

- Finalize the form by signing and dating it in the authorized officer's section. Ensure the information provided is truthful and complete.

- Review the completed form for accuracy, then save your changes. Options will be available to download, print, or share the document as necessary.

Start completing your documents online today for swift and efficient processing.

A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity. The franchise tax effectively charges corporations for the privilege of doing business in the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.