Loading

Get Tx Trs15 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS15 online

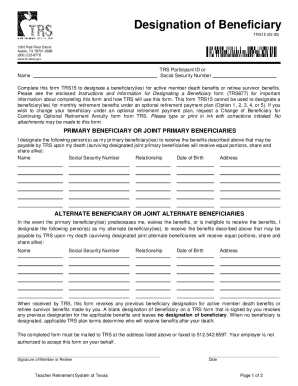

The TRS15 form is essential for designating beneficiaries for active member death benefits or retiree survivor benefits. This guide offers step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the TRS15 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in your TRS participant ID or Social Security Number in the designated field. This allows TRS to identify your account and record your beneficiaries accurately.

- Enter your full name in the next field. Ensure it matches the name associated with your TRS account for verification purposes.

- In the primary beneficiary section, provide the necessary information for each primary beneficiary you designate, which includes their name, Social Security Number, relationship to you, date of birth, and address. If you designate more than one beneficiary, ensure they are listed evenly for equal shares.

- In the alternate beneficiary section, similarly fill out the required details for each alternate beneficiary. This step is crucial in case your primary beneficiaries are unable to receive their benefits.

- Review all the entered information carefully. Initial any corrections you made to avoid disputes regarding your beneficiary designations.

- Sign the form in the designated area. TRS recommends using an ink color other than black and initialing any corrections. If applicable, follow the procedures for users unable to provide a signature as outlined in the instructions.

- Once completed, submit the form by mailing it to the address provided or faxing it. Ensure TRS receives your form before your death for the designation to be effective.

Complete your TRS15 form online today to ensure your beneficiary designations are up to date.

In those states, teachers and other state and local government workers are exempt from paying Social Security taxes and instead typically rely on a state-run pension plan. So, why aren't teachers covered? The short answer: In part, it's because they don't pay into the Social Security system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.