Loading

Get Va Form Np-1 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form NP-1 online

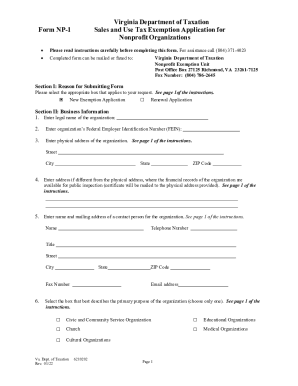

This guide provides a clear and detailed process for completing the VA Form NP-1 online, which is essential for nonprofit organizations seeking a sales and use tax exemption. Follow these steps to ensure that your application is accurately filled out and submitted.

Follow the steps to successfully complete the VA Form NP-1

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- In Section I, choose the appropriate option for your submission by selecting either 'New Exemption Application' or 'Renewal Application'. Make sure to check the box that applies to your request.

- Proceed to Section II and enter the organization’s legal name, Federal Employer Identification Number (FEIN), and the physical address of your organization. Ensure accuracy in these fields as they are crucial for identification purposes.

- If your organization has a different address for public inspection of financial records, fill that in next. Then, provide the name, title, mailing address, and contact information for a designated contact person.

- Select one option that best describes your organization's primary purpose from the list provided, such as 'Civic and Community Service Organization' or 'Educational Organization'. Only one selection is allowed.

- If your organization is a church, respond to the question in Section III regarding the type of exemption being applied for. Choose either 'Option 1 - Form ST-13A' or proceed to Section V for financial information if applying for a tax-exempt number.

- In Section IV, select the relevant box that indicates whether your organization is exempt from selling tax on products or services. Review the categories available and choose only one.

- Section V requires you to enter the total dollar amounts for the organization’s annual gross revenue, fundraising expenses, and administrative expenses from the previous year. If your organization is new and lacks financial information, enter zero in the appropriate fields.

- In Section VI, indicate whether your organization intends to make purchases in Virginia by selecting 'YES' or 'NO'. Provide estimated purchase amounts if applicable.

- Answer the question regarding your organization's requirement to file federal Form 990. Depending on your answer, additional information about the Board of Directors or federal filings may be requested.

- Finally, in Section VII, ensure that an authorized representative signs and dates the application, confirming the accuracy of the information provided.

- Before submitting, review the checklist of requirements to make sure all necessary documents and signatures are included. Once complete, save your changes and proceed to print or download the form as needed.

Complete your VA Form NP-1 online today to ensure your nonprofit organization can benefit from tax exemptions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.