Loading

Get Irs 8275 2013-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8275 online

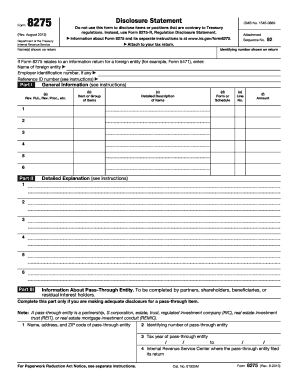

Filling out the IRS Form 8275 is an essential step for those wishing to disclose items or positions that may not be aligned with Treasury regulations. This comprehensive guide will walk you through each section of the form to ensure accurate and complete submissions.

Follow the steps to accurately complete Form 8275 online.

- Press the ‘Get Form’ button to access the IRS 8275 and open it in your editor.

- Begin by entering the identifying number shown on your tax return at the top of the form. This is crucial for linking this disclosure statement to your main tax filing.

- In Part I, input general information about the items you are disclosing. For each item, fill in the requested details including Rev. Rul. or Rev. Proc., item description, form or schedule number, line number, and the amount associated with each item.

- Once you have filled out all sections accurately, review the entire form for any errors or missing information.

Begin your process of submitting documents online with confidence by completing the IRS 8275 today.

IRS 8275 refers to a specific form used for disclosing tax positions that may differ from IRS interpretations. It allows taxpayers to clarify their tax returns, thereby reducing the chance of penalties for undisclosed positions. Understanding IRS 8275 is essential for anyone looking to navigate complex tax landscapes with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.