Loading

Get Sc Pr-26 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PR-26 online

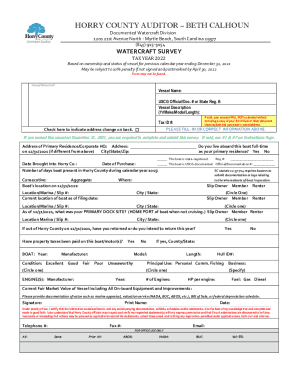

Completing the SC PR-26 form is an essential step for individuals who owned a vessel on December 31 of the previous year. This guide provides clear and structured instructions to help you navigate the online filling process with ease.

Follow the steps to successfully complete the SC PR-26 form.

- Press the ‘Get Form’ button to access the SC PR-26 online and open it in your editing application.

- Begin by filling in the vessel's name and its USCG Official/Documentation number or State Registration number. Make sure these are correct, as any errors may impact your submission.

- In the vessel description section, accurately provide the year, make, model, and length of your watercraft. This information is crucial for taxation purposes.

- Indicate whether the vessel was sold during the previous calendar year and whether you have attached the Bill of Sale or similar documentation. Ensure that all required documents are included if applicable.

- Provide your Tax ID number and verify if your primary residence or corporate headquarters address is correct. Use the checkbox if there has been an address change.

- Input the date you brought the vessel into Horry County and the address where the boat is currently located as of the filing date.

- Complete the section regarding whether you live aboard your boat full-time, as well as details about its condition, the number of days it was present in Horry County, and its primary use.

- Once all fields are completed and double-checked for accuracy, save your changes, and then download or print the completed SC PR-26 form.

- Finally, submit the form by mailing it before the deadline to avoid any penalties. Make sure to postmark it before April 30.

Start filling out the SC PR-26 form online today to ensure your compliance and avoid penalties.

Privately owned passenger vehicles: 6% of retail value. Business owned vehicles: 10.5% of retail value. Trucks with an empty weight over 9,000 lb or a gross weight over 11,000 lb: 10.5% of retail value (the weight used is provided by the manufacturer) including privately owned vehicles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.