Loading

Get Mo Form 5633

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Form 5633 online

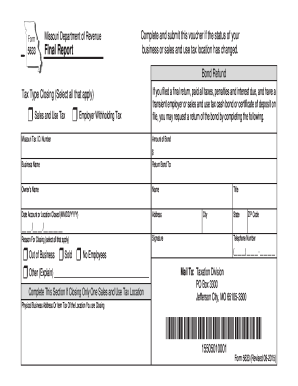

Filling out the Mo Form 5633 online is a straightforward process designed to help individuals and businesses report changes in their sales and use tax location status. This guide will walk you through each section of the form, ensuring that you complete it correctly and efficiently.

Follow the steps to complete your Mo Form 5633 accurately

- Click the ‘Get Form’ button to access the Mo Form 5633 and open it in your editing tool.

- Begin by selecting the tax types relevant to your situation, such as 'Sales and Use Tax' or 'Employer Withholding Tax.' Make sure to check all that apply.

- Enter your Missouri Tax I.D. Number carefully to ensure accurate processing of your form.

- If you have filed a final return and cleared all pending taxes, penalties, and interest, specify the amount of bond you are requesting to be returned.

- Provide your business name in the designated field, followed by the owner's name and title.

- Indicate the date your account or location was closed, using the MM/DD/YYYY format.

- Fill in your address details, including street address, city, state, and ZIP code.

- Select the reason(s) for closing your business, ensuring you check all that apply, such as 'Out of Business' or 'Sold.' If applicable, provide additional explanations.

- Sign the form to verify the accuracy of the information provided and include your telephone number for contact purposes.

- Once completed, you can choose to save your changes, download the form, print it, or share it as needed.

Complete your Mo Form 5633 online today to ensure your tax-related matters are addressed promptly.

Related links form

You may be unable to e-file your Missouri tax return due to missing information or not using an approved e-filing platform. Ensure that your Mo Form 5633 is completed correctly and that there are no discrepancies. If you continue to face issues, consider reaching out to the Missouri Department of Revenue for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.