Loading

Get Sc Dor C-245 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR C-245 online

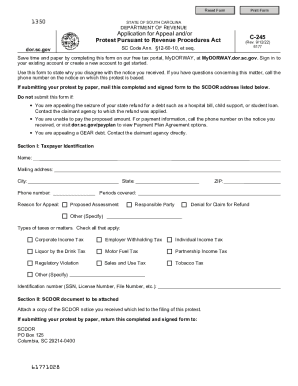

The SC DoR C-245 form is crucial for individuals who wish to appeal or protest decisions made by the South Carolina Department of Revenue. This guide will provide a clear walkthrough on how to complete the form online, ensuring your voice is heard regarding any disagreement with revenue notices.

Follow the steps to complete the SC DoR C-245 form online effectively.

- Press the ‘Get Form’ button to obtain the SC DoR C-245 form and open it in your online document platform.

- Begin by filling out Section I, which requires your taxpayer identification details. Provide your full name, mailing address, city, state, ZIP code, and phone number. Clearly state your reason for the appeal and specify the periods covered.

- In Section I, check off the types of taxes or matters you are appealing, such as individual income tax or sales and use tax. Be sure to indicate your identification number, which could be your Social Security Number or another applicable identifier.

- Proceed to Section II. Here, you must attach a copy of the SCDOR notice that prompted this protest. Ensure all documents are complete and ready for submission.

- Move on to Section III. This section asks for the reasons behind your protest. Detail why you disagree with the notice findings, support your position with relevant facts, and, if applicable, provide legal authority for regulatory violations.

- In Section IV, ensure signatures are provided where necessary. If the protest involves a joint return, both taxpayers must sign. For corporations, include the name and signature of an authorized corporate officer.

- Once you have completed all sections and ensured accuracy, proceed to save changes. You may then download, print, or share the completed form as per your needs.

Complete the SC DoR C-245 form online today to ensure your appeal is processed efficiently.

The Department of Revenue is a department of the South Carolina state government responsible for the administration of 32 different state taxes in South Carolina. The Department is responsible for licensing and taxing all manufacturers, wholesalers and retailers of alcoholic liquors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.