Loading

Get Ky Form 2210-k 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form 2210-K online

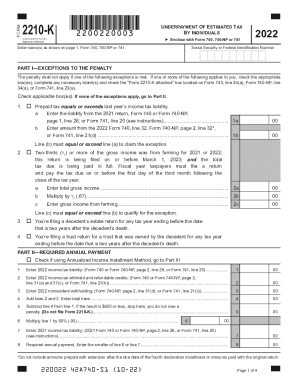

The KY Form 2210-K is essential for individuals who may owe an underpayment penalty for failing to submit adequate estimated tax payments throughout the year. This guide provides clear instructions on how to complete the form online efficiently and correctly.

Follow the steps to fill out the KY Form 2210-K online.

- Click ‘Get Form’ button to acquire the KY Form 2210-K and open it in the editor.

- Begin by entering your name(s), exactly as shown on page 1 of your Form 740, 740-NP, or 741.

- Proceed to Part I. Check any applicable exceptions to the penalty. If you believe you qualify for an exception, mark the appropriate box(es) and complete the necessary fields, ensuring to check ‘Form 2210-K attached’ on the specified line of your primary form.

- Move to Part II. Enter your 2022 income tax liability found on the appropriate line of your primary form.

- Next, input the total of your 2022 income tax withheld and refundable credits. Sum the amount from each relevant line of your primary form and record it.

- Calculate your required annual payment on lines 4 through 8. Make sure to follow the calculation instructions precisely to avoid errors.

- Transition to the payments due. In Part II, identify the required installments due on specified dates. Record each calculated payment in the corresponding columns.

- Complete the calculations for underpayments in Part II to ensure you accurately determine any penalties.

- If applicable, turn to Part III for the annualized income installment method. Follow the specific instructions to complete this section if your income varied throughout the year.

- Review all entries for accuracy. Save your changes, and once confirmed, you can download, print, or share the form as needed.

Complete your KY Form 2210-K online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

1. Late Filing Penalty: The penalty is 2% of the total taxes owed for every 30 days or fraction of that time that a return is filed after the tax return deadline. The maximum penalty is 20% of the taxes owed amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.