Loading

Get Ut Tc-65 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-65 online

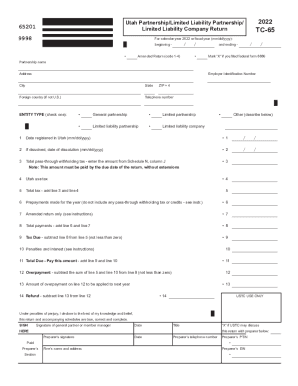

The UT TC-65 is an essential form for partnerships and limited liability entities in Utah. This guide will provide you with step-by-step instructions for completing the form online, ensuring that you accurately report your entity's income and taxes.

Follow the steps to effectively complete the UT TC-65 online.

- Press the ‘Get Form’ button to access the UT TC-65 form and launch it in your online editor.

- Enter the tax year for which you are filing at the top of the form.

- Fill in the partnership name and address, including city, state, and ZIP code. Ensure that the information is complete and accurate.

- Input the Employer Identification Number (EIN) associated with your entity.

- Indicate the type of entity by checking the appropriate box (general partnership, limited partnership, limited liability partnership, limited liability company, or other).

- Provide the date your entity was registered in Utah and, if applicable, the date of dissolution.

- Enter the total pass-through withholding tax as indicated in the specific section, ensuring this amount is submitted on or before the due date.

- Calculate and input the Utah use tax.

- Determine the total tax by adding the pass-through withholding tax and the Utah use tax together.

- Report any prepayments made for the year, excluding pass-through withholding tax.

- If this is an amended return, complete the additional steps for the amended entry.

- Calculate the total payments made, including any prepayments and estimated payments.

- Determine tax due by subtracting total payments from the total tax calculated earlier.

- If applicable, calculate any penalties and interest as instructed.

- Sum the tax due and any penalties or interest for the total amount due.

- If an overpayment occurred, complete the sections regarding the amount to be applied to the next year or the refund requested.

- Finally, sign and date the form, ensuring that all preparer information is correctly filled in.

Complete your documents online to ensure timely and accurate filing.

Related links form

A “partner” includes a partner or member of one of these entities. A partnership is not subject to Utah income tax. However, partners conducting business are liable for Utah income tax in their separate or individual capacities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.