Loading

Get 1996 Form 709

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1996 Form 709 online

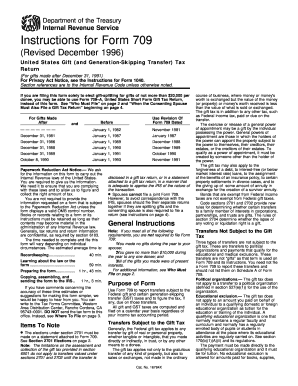

This guide provides a comprehensive overview of how to complete the 1996 Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, online. Follow these detailed instructions to ensure you accurately report your gifts and comply with tax obligations.

Follow the steps to fill out the 1996 Form 709 online successfully.

- Press the ‘Get Form’ button to obtain the 1996 Form 709 and open it in your preferred online document editor.

- Begin by filling in your personal information in Part 1, including your name, address, and taxpayer identification number. Ensure that the details are accurate and reflect your current status.

- Next, indicate whether you are electing gift splitting with your spouse if applicable. This involves checking the appropriate boxes and providing your spouse's consent.

- Proceed to Schedule A, where you will list all taxable gifts made during the calendar year. Separate gifts that qualify for the gift tax from those that do not, ensuring each entry includes a description and value.

- If you have made direct skips subject to Generation-Skipping Transfer Tax, complete Part 2 of Schedule A, detailing each gift and its recipient.

- Review the gift valuation and ensure any discounts are accurately reflected if applicable. Attach supporting documentation if required, such as appraisals.

- Complete the tax computation sections, including any deductions, exclusions, or elections applicable to your situation.

- Finally, after confirming all information is correct, save your changes. You may download, print, or share the completed form as needed.

Start filling out your Form 709 online today to ensure compliance with gift tax regulations!

The 1996 Form 709 is filed separately from your annual income tax return. It needs to be submitted by its own deadline, which is typically April 15, without attaching it to your Form 1040. Filing this form separately ensures that it is processed correctly as a gift tax document. For ease and accuracy, consider using services from US Legal Forms when filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.