Loading

Get Ky Dor 725 (41a725) 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the KY DoR 725 (41A725) online

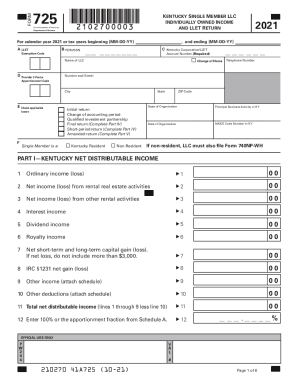

Filling out the KY DoR 725 (41A725) online is a straightforward process that allows individuals with single-member limited liability companies (LLCs) to report their income and tax obligations. This guide will provide you with detailed steps to complete the form accurately and efficiently.

Follow the steps to fill out the KY DoR 725 (41A725) effectively.

- Press the ‘Get Form’ button to access the KY DoR 725 (41A725) form and open it for editing.

- Fill in the calendar year or tax years for which you are filing the return at the top of the form. Ensure to use the correct format (MM-DD-YY) for both the beginning and ending dates.

- Provide your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) in the designated fields. This information is crucial for identifying your tax records.

- Enter the name of your LLC as registered, followed by the address where the business operates. Ensure accuracy to avoid processing delays.

- Indicate whether you are a Kentucky Resident or Non-Resident by checking the applicable box. If non-resident, additional forms may be required.

- In Part I, record your financial data, such as ordinary income, rental income, interest income, and any deductions. Use attached schedules where required to provide detailed information.

- Complete Part II for LLET computation by entering all relevant figures including any applicable credits. Ensure calculations are accurate and align with your financial records.

- If this is a final return, complete Part IV to explain the reason for finality, such as cessation of operations or change of ownership.

- After filling out the form, review all information for accuracy. Make any necessary corrections.

- Save your changes, then choose to download, print, or share the form as needed. Ensure all supporting documents are attached before submission.

Complete your KY DoR 725 (41A725) form online for a streamlined filing process.

For tax periods prior to January 1, 2023, the tax is 1.49% of the gross compensation paid. Beginning January 1, 2023, the tax is 1.65% of the gross compensation paid. Forms and instructions are available at the Occupational Tax Office or may be downloaded below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.