Loading

Get Ny It-196 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-196 online

Filling out the NY IT-196 form can seem overwhelming, but with clear guidance, you can complete it efficiently. This guide provides a step-by-step approach to ensure you fill out the form accurately and submit it with confidence.

Follow the steps to complete the NY IT-196 online.

- Press the ‘Get Form’ button to obtain the NY IT-196 form and open it in your editing tool.

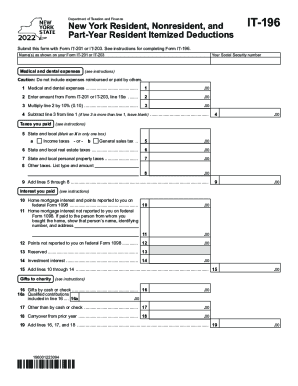

- Enter your name(s) as displayed on your Form IT-201 or IT-203, followed by your Social Security number in the designated fields.

- In the section for medical and dental expenses, input your total medical expenses on line 1. Remember to exclude any expenses that have been reimbursed or paid by others.

- On line 2, transfer the amount from Form IT-201 or IT-203, line 19a.

- Calculate 10% of the amount on line 2 and record this on line 3.

- Subtract line 3 from line 1 and record on line 4, leaving it blank if line 3 exceeds line 1.

- For taxes paid, mark an X in the appropriate box for state and local taxes on lines 5 through 8, and enter the total on line 9.

- In the interest paid section, fill in your home mortgage interest amounts as reported on federal Form 1098, and any additional interests not reported, on lines 10 to 12.

- For charitable contributions, document both cash donations on line 16 and other contributions on line 17. Add them together with any carryovers from previous years on line 19.

- Record any casualty and theft losses on line 20, followed by any job-related expenses on lines 21 to 24.

- Add total job expenses and make necessary calculations for deductions as outlined in the instructions for lines 25 to 39.

- Complete the adjustments section, including any applicable college tuition deductions, and ensure all figures are accurately calculated.

- Finally, review the summary of your itemized deductions on line 49 before saving, downloading, printing, or sharing your completed form.

Start filling out your NY IT-196 form online today and simplify your tax deductions!

Related links form

So, if you earn an income or live in NY, you must pay NY state tax. As a traditional W-2 employee, your NYS taxes will be drawn on each payroll automatically. You will see this on your paycheck, near or next to the federal taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.