Loading

Get Eftps Forms Print

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eftps Forms Print online

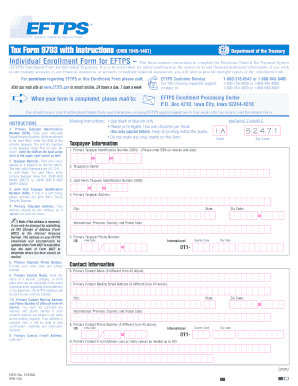

This guide provides step-by-step instructions for completing the Electronic Federal Tax Payment System (EFTPS) Enrollment Form for Individual Taxpayers. Whether you are enrolling for the first time or updating your financial institution information, this guide aims to assist you in filling out the form accurately and efficiently.

Follow the steps to complete your EFTPS form.

- Click ‘Get Form’ button to obtain the EFTPS Enrollment Form and open it in your editing tool.

- In the first section, enter your Primary Taxpayer Identification Number (SSN). Ensure you provide your nine-digit Social Security Number as it appears on your tax return. If you are a joint filer, provide the primary taxpayer's SSN and also include it on the back of the form in the specified area.

- Next, print the Taxpayer Name(s) exactly as shown on the tax return. If applicable, list the primary taxpayer's name first in the format: 'JOHN AND MARY SMITH' or 'JOHN SMITH AND MARY JONES'.

- If this is for a joint filing, provide the Joint Filer Taxpayer Identification Number (SSN) in the designated field.

- For the Primary Taxpayer Address, input the address as it appears on your tax return. If there are any inconsistencies, you will need to submit a Change of Address (Form 8822) to the IRS.

- Provide the Primary Taxpayer Phone Number, including the area code. This is necessary for contact purposes.

- Fill in the Primary Contact Name, which could be a person or entity that can be reached regarding your enrollment or tax payments.

- If the mailing address for your Primary Contact is different from the Primary Taxpayer Address, fill in that information in the relevant fields.

- Optionally, provide a Primary Contact Email Address, up to 60 characters.

- Choose your Payment Method by checking the EFTPS-Direct option if you wish for EFTPS to transfer payments from your account. Indicate your preference here.

- In the Payment Amount Limit section, you may set an amount limit for tax types to avoid overpayments.

- Fill in your Routing Number (RTN), which is essential for processing your payments. This is a nine-digit number provided by your financial institution.

- Enter the Account Number that you will use to make your tax payments.

- Specify whether your account type is Checking or Savings by marking the corresponding box.

- Indicate the state and zip code of your financial institution's location.

- Review the Authorization section carefully. Sign this section to authorize the U.S. Treasury to initiate tax payments from the designated accounts.

- Ensure the Taxpayer Signature and Date fields are completed. If applicable, also provide the Joint Filer’s Signature and Print Name.

- Once you have filled out the form completely and accurately, save your changes. You can then choose to download, print, or share the completed enrollment form.

Begin completing your EFTPS Enrollment Form online today!

Start by logging into the tax service or IRS portal where you submitted your tax return. Navigate to the area for past filings, select the return you wish to download, and choose the PDF option. The Eftps Forms Print tool ensures your downloads are formatted correctly for simplicity and easy printing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.