Loading

Get Ny It-558-i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-558-I online

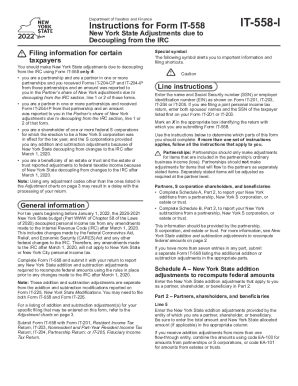

The NY IT-558-I form is essential for certain taxpayers to report New York State adjustments due to decoupling from the Internal Revenue Code (IRC). This guide provides clear, step-by-step instructions to help you navigate and complete the form online with confidence.

Follow the steps to fill out the NY IT-558-I accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and Social Security number (SSN) or employer identification number (EIN) as shown on Form IT-201, IT-203, IT-204, or IT-205. If filing jointly, include both names and the SSN of the primary taxpayer.

- Mark an X in the appropriate box to identify the return you are submitting with Form IT-558.

- Determine which parts of the form are applicable to you based on your partner, shareholder, or beneficiary status.

- Complete Schedule A, Part 2, to report your New York additions from a partnership, S corporation, or estate/trust.

- Complete Schedule B, Part 2, to report your New York subtractions from a partnership, S corporation, or estate/trust.

- If you have more than seven entries for additions or subtractions, submit a separate Form IT-558.

- Enter the New York State addition adjustments that apply to you in the corresponding lines as indicated in the form.

- For subtraction adjustments, ensure you enter the correct codes and totals in the designated sections.

- Review all entries for accuracy and completeness before submitting the form with your income tax return.

- Save changes, download, print, or share the form as needed after completing the necessary sections.

Complete your forms online for convenience and accuracy.

Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.