Loading

Get Nc E-536r 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-536R online

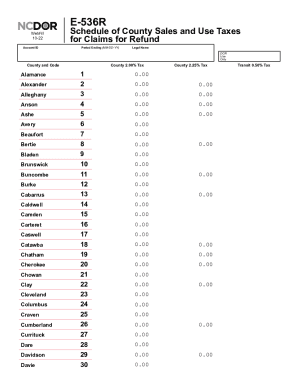

The NC E-536R form is essential for filing claims for refunds related to county sales and use taxes. This comprehensive guide will help you navigate the online completion of the form with ease, ensuring you meet all requirements.

Follow the steps to successfully fill out the NC E-536R online.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter your legal name in the appropriate field where indicated at the top of the form.

- Provide your Account ID, making sure to enter this correctly to avoid delays in processing.

- Specify the period ending date in the format MM-DD-YY, which is crucial for identifying the correct tax period.

- Select the county from the dropdown list. Ensure you choose the correct county as various tax rates apply based on location.

- Fill in the corresponding tax amounts under each relevant category (2.00% Tax, 2.25% Tax, and Transit 0.50% Tax). Be careful to enter the totals accurately, ensuring they correspond with your records.

- Verify all entries for accuracy. Cross-check the provided information with your tax documents to minimize errors.

- Once all sections are completed and verified, you can save your changes, download a copy, or print the form directly for your records.

Begin filling out your NC E-536R form online today to ensure timely processing of your tax refund.

North Carolina General Statute 105-241.8 defines their statute of limitations for sales tax assessment as 3 years from the later of the return due date or the return filing date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.