Loading

Get Irs 1120 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 online

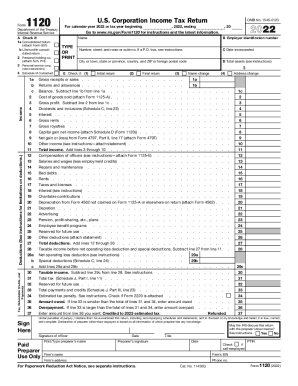

The IRS Form 1120 is a crucial document for corporations to report their income, deductions, and tax liability. Understanding how to accurately complete this form online can streamline the filing process and ensure compliance. This guide provides a comprehensive overview of each section and field to help users navigate the form with ease.

Follow the steps to successfully complete the IRS 1120 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Provide the corporation's name, Employer Identification Number, and address in sections A, B, and C. Make sure the information is current and accurate.

- Indicate the tax year for which you are filing the return. This information is usually specified at the top of the form.

- Fill out the income section, including total income calculations from various sources such as gross receipts, dividends, and other income. Ensure that you calculate totals accurately.

- Proceed to the deductions portion of the form. List out all applicable deductions, including salaries, interest, and other expenses. Attach supporting documents when necessary.

- Complete the tax computation section based on the taxable income calculated. Make sure to refer to necessary schedules or forms mentioned within the instructions.

- Sign and date the form. If someone other than the taxpayer is preparing the form, include their information as well.

- Review the entire form for accuracy and completeness before proceeding to save, download, print, or share the completed document.

Take the next step in managing your corporate tax responsibilities by completing the IRS 1120 form online today.

The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.