Loading

Get Irs 990 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 online

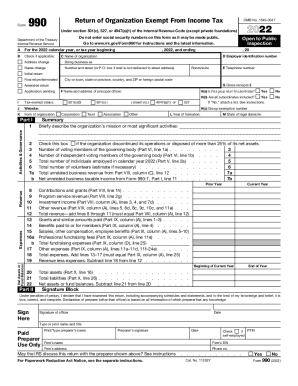

This guide provides a clear and supportive overview of filling out the IRS 990 form online. It is designed to assist users with varying levels of experience in completing this important document for tax-exempt organizations.

Follow the steps to effectively fill out the IRS 990 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide the organization's basic information, including the name, employer identification number, and address. Ensure that the information accurately reflects the organization’s current status, including any name or address changes applicable.

- Indicate the tax-exempt status of the organization by checking the appropriate box. This section encompasses different types of organizations, such as those under 501(c)(3) or 501(c)(4).

- Briefly describe the organization’s mission and significant activities in the relevant section. Ensure this description is concise yet informative enough to convey the primary activities that the organization undertakes.

- For revenue and expenses, fill in the respective sections. This includes detailing contributions, program service revenue, and expenses related to fundraising and other operational costs. Accurately report total revenues and net assets.

- Complete the checklist of required schedules. This will include indicating whether the organization has engaged in specific activities, such as political campaigns or significant changes in governance.

- Sign and date the form as necessary. Ensure that the responsible individual, such as an officer or authorized representative of the organization, verifies the information's accuracy before submission.

- After completing the form, you can save changes, download, print, or share the form according to your preferences or requirements for submission.

Complete your IRS 990 form online today to ensure compliance and transparency for your organization.

Form 990 is intended to provide the government and interested members of the public with a snapshot of the organization's activities for that year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.