Loading

Get Irs W-12 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-12 online

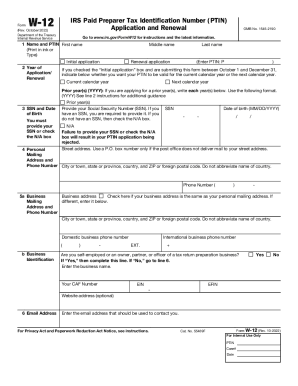

The IRS W-12 form is essential for individuals seeking a Paid Preparer Tax Identification Number (PTIN). This guide provides a comprehensive, step-by-step approach to help you navigate the online application process for the form.

Follow the steps to fill out the IRS W-12 form with ease.

- Click ‘Get Form’ button to retrieve the IRS W-12 form and open it in the editor.

- Begin by filling out your first name, middle name (if applicable), and last name in the appropriate fields. Indicate whether this is an initial application or a renewal.

- In the year of application/renewal section, select the calendar year for which your PTIN should be valid. Indicate any prior years if applicable.

- Provide your Social Security Number (SSN) or check the N/A box if you do not have one. This information is required for your application.

- Input your current mailing address, ensuring to include city, state, and ZIP code. Use a P.O. box only if your street address is not deliverable.

- If you operate a business, complete the business address section. If it is the same as your personal mailing address, check the box and proceed. Otherwise, provide the necessary business address details.

- Enter your email address that is preferred for communication about your application.

- Respond to the felony conviction question by checking the appropriate box. If applicable, provide details regarding any convictions.

- For those renewing, provide the address used on your last U.S. individual income tax return and check if you have never filed one.

- Indicate your current tax compliance status regarding federal taxes, along with any necessary explanations if not current.

- Acknowledge your understanding of data security responsibilities for paid preparers by responding appropriately.

- Check any professional credentials that apply to you and provide the necessary jurisdiction and identification numbers.

- Finally, provide your signature and date at the bottom of the form, verifying the truthfulness of your application.

- Upon completion, review your form for accuracy. You can now save changes, download, print, or share the completed W-12 form.

Start completing your IRS W-12 form online today to ensure a smooth application process.

Answer: To access your online PTIN account, go to the PTIN system login page. Then click “Log In”. Enter your User ID and Password in the designated fields, click “Log In”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.