Loading

Get Va Dot 763 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 763 online

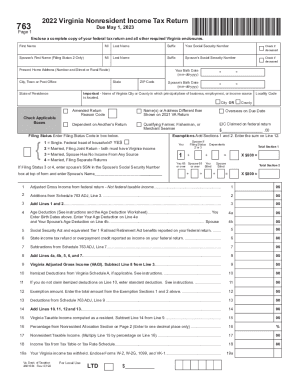

The VA DoT 763 form is essential for nonresident individuals filing their income tax returns in Virginia. This guide provides step-by-step instructions on how to complete this form successfully to ensure compliance with tax regulations.

Follow the steps to fill out the VA DoT 763 accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your first name, middle initial (if applicable), last name, and any suffixes. Additionally, input your Social Security number and mark the box if deceased.

- If you are filing jointly, provide your spouse's first name, middle initial, last name, social security number, and indicate if deceased.

- Fill in your current home address, including the number and street, city, state, and ZIP code.

- Indicate your birth date and check the appropriate filing status code. This includes options such as single, married filing jointly, married filing separately, etc.

- Specify any applicable exemptions and enter the total in the designated line.

- Calculate your adjusted gross income based on your federal return and enter it accurately.

- Complete lines related to deductions, including age deductions if applicable, and ensure all entries are totalled and computed correctly.

- Enter information regarding any estimated tax payments or credits from previous years as required.

- Review all entries for accuracy, save your progress, and finalize the document by downloading or printing it for submission.

Start filling out your VA DoT 763 online to ensure timely submission!

Virginia Schedule 763 ADJ, also known as the Virginia Schedule of Adjustments for Nonresident is a supplemental income tax form that nonresidents must file together with Form 763 in order to claim certain credits, declare additions or subtractions from one's adjusted gross income and to declare voluntary contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.