Loading

Get Oh Kr-1040 - Kettering City 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH KR-1040 - Kettering City online

Filling out the OH KR-1040 - Kettering City form correctly is essential for ensuring accurate tax reporting and any potential refunds. This guide provides a step-by-step breakdown of how to complete the form online, ensuring ease and clarity for all users.

Follow the steps to successfully complete the OH KR-1040 form online.

- Click the ‘Get Form’ button to access the form and open it for filling out.

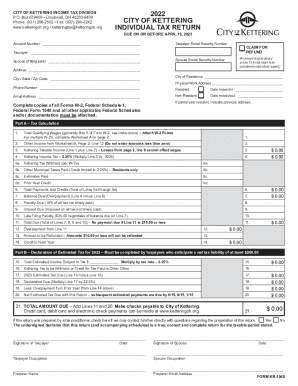

- Enter your taxpayer Social Security Number and account number in the designated fields at the top of the form.

- Fill out the taxpayer and spouse information, including names and Social Security Numbers, if applicable. Ensure that the address field is complete, including the city, state, and zip code.

- Indicate your city of residence and provide your physical work address, if different. Include your phone number and email address for correspondence.

- In Part A, begin calculating your tax. Enter your total qualifying wages as indicated, including the submission of your W-2 Forms.

- Complete all applicable lines for your income calculation by adding other income as necessary, following the instructions for losses and municipal tax credits.

- Review the total payments and credits to determine any balance due or refund amount. The figures will auto-calculate based on your previous entries.

- In Part B, if applicable, enter your estimated tax for 2023, especially if your net tax liability is projected to be at least $200.

- Ensure all required schedules and documentation are attached if necessary, as incomplete submissions may lead to delays.

- Sign and date the form in the appropriate sections, ensuring to include the spouse’s signature if filing jointly.

- Finally, save your changes, download the completed form, and prepare to print or share it as needed for submission.

Complete your OH KR-1040 - Kettering City form online efficiently today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Calendar Year 2023: 7% per year or 0.58% per month. Forms may be obtained by calling our office at (937) 296-2502 or go directly to the forms page. The City of Kettering Income Tax Division now accepts credit card and debit card payments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.